As the recent review of Social Investment Tax Relief (‘What a Relief!’) outlines, there have been challenges to SITR reaching its potential. Here, we look at three actions we can take to help unlock it.

Let’s start this blog with a reminder of what Social Investment Tax Relief is and what it is designed to do.

SITR is a tax relief for individual investors (usually those who are HNWI or sophisticated investors). It incentivises investment into social enterprises and charities by offering a 30% tax relief against the value of the investment made.

During the first four years since SITR was introduced there have been numerous press articles, report and commentary on the ‘disappointing results’, ‘missed opportunities’ and a raft of other generally demotivating descriptions. Whilst I’m an eternal optimist, even I can’t quite find it in myself to totally ignore these perspectives. However, I feel strongly that this isn’t the whole story.

In David Floyd’s recent review, ‘What a Relief!’ for Social Investment Business, he summarises the main challenges and outlines a number of recommendations for the government, voluntary sector and social investors. He also concludes his review by saying "the relief does have potential to help meet some of the demand for risk finance in the social investment market".

You can read the full report at: What a Relief! A review of Social Investment Tax Relief for charities and social enterprises.

So what can we do to unlock SITR’s potential?

Alongside the report’s recommendations, here’s three actions I believe we can all do to make a difference.

1. Lobby government

With the forthcoming HMRC consultation on SITR announced in last year’s Civil Society Strategy, there are two clear asks that social enterprises and charities alongside the social investment sector should lobby for:

- Extend the range of eligible trading activities to include some aspects of property usage, leasing of community assets, care homes and community energy seem key.

- Simplify and standardise the process of applying and administering for SITR and provide support for social enterprises and charities who are looking to raise investment using SITR.

Most of all, we need to ensure that HMRC recognises that social enterprises and charities are not the same as mainstream businesses. And simply transposing a mainstream relief like EIS to SITR can’t fulfil the sector’s needs.

2. Raise awareness

Another key action we can all take is to shout about it so more organisations are aware of it.

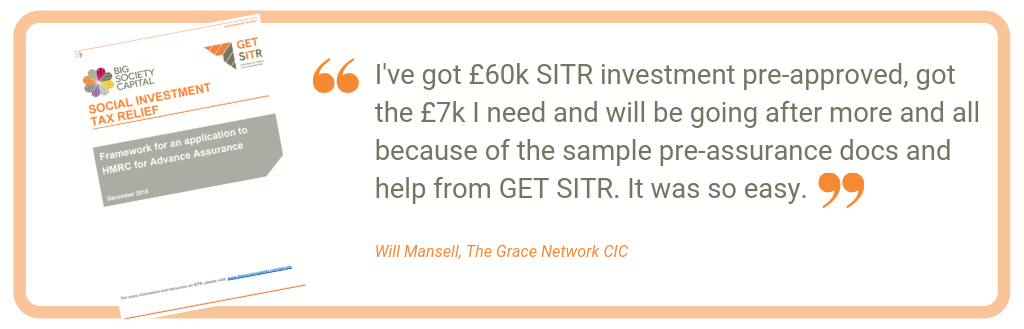

The focus of our work through GET SITR is to raise awareness of the tax relief as well as removing technical barriers for organisations using it where we can. We do this by providing free expert tax advice through 1:1 SITR surgeries and webinars. We have also published a number of resources both for organisations looking to raise investment as well as for advisers and investors.

For instance, we recently published an editable Advance Assurance Framework, which organisations can use to apply for pre-assurance on SITR from HMRC. And we’re delighted that it’s already having a positive impact. Will Mansell from The Grace Network CIC told us that he's already got £60,000 SITR investment pre-approved as a result.

WHAT YOU CAN DO: Help us reach a wider audience

If you would like to partner with us or have suggestions about how we can do this, please do get in touch. We would love to hear from you.

3. Develop a solid evidence base on SITR & share insights

At the moment, it’s unclear just how many social enterprises and charities have actually used the relief. To help provide an up-to-date picture, GET SITR has created an open-source database of SITR Investment Deals. We hope this will give us a sense of the size of the market, the types of organisations who have used SITR and how this type of capital is working for the sector.

WHAT YOU CAN DO: Help us improve the data

One of the areas there is little information about is on SITR investments that have been raised by an organisation as a ‘direct’ deal. This essentially means that a social enterprise or charity has identified lenders themselves without the support of an investment intermediary (although they may well have engaged the support of a professional service such as a lawyer, wealth manager or financial adviser).

If your organisation has raised investment using SITR in this way or another (you can find all the ways you can raise SITR investment here), we want to hear from you.

As an incentive, GET SITR would like to raise the profile of organisations that have raised the investment and the impact they are making through a number of ways.

This data will give us a solid evidence base to use as part of the HMRC consultation on SITR. You give us the ammunition and we will happily fire the shot and take the battle for SITR forward.

After 10 million pounds of SITR deals to date, we know there is a clear need for patient and affordable capital for social enterprises and charities. We really believe SITR can be part of that solution - its full potential just needs to be unlocked.